If an organization has a debt to a counterparty-supplier, it can provide services to the counterparty or supply goods in exchange for the debt. Also, the counterparty-buyer can supply services or goods against his debt. To correctly display such transactions in accounting, it is necessary to carry out the netting procedure.

The process of netting in 1C 8.3 is automated and is carried out using the standard document “Debt Adjustment”.

Settlements with clients

To begin, let’s create a standard sales agreement and select orders from ZK customers as the settlement object (the most detailed option):

The agreement also specifies the payment schedule for the contract (how and within what time the contract will be paid). In our example, the purchase order will be paid 5 days after shipment (i.e. postpayment):

You can also apply a filter to the type of payment accepted under the agreement:

In addition to postpayment, advance and prepayment can be selected.

The difference between them is that an advance implies the possibility that we may not yet have the goods at all (i.e., we will not even be able to organize the provision of goods in the purchase order until we register the receipt of an advance on it), and an advance payment provides that the goods is in stock at our warehouse and will be shipped immediately after payment.

Now we create the contract itself, we see that the payment schedule has been filled out according to the agreement:

In this case, the payment date is filled in based on the Desired shipment date

(since it is empty,

the date of shipment

):

Now, based on the contract, we formalize the implementation:

In the list of CPs, the current state changes:

When you double-click on it, a report on the execution status opens:

Now you need to register the receipt of payment from the client. The fastest way is to create a Non-cash Receipt

.

But there is another way - in the Non-cash payments

, use the

For receipts

:

The document is almost completely filled out, do not forget to set the indicator of the payment being made by the bank:

On the second tab we see that it is the ZK that is used as the calculation object. Thanks to the choice of the DDS article in the agreement, it is now substituted itself:

Now the ZK is ready for closure, there are no debts:

The status of settlements can be monitored using the Statement of Accounts Receivable

:

Now let's conduct an experiment - create several implementations according to our agreement, but without using the ZK:

In the report we can see that sales documents are shown as the object of settlements (despite the fact that mutual settlements are carried out on orders):

Now let’s register payment from the client for these implementations, while creating one payment order:

In the payment decryption, select the filling type : List

and click

Select by balance

:

Select the ones you need from the list and transfer them to the payment order:

Please note that the journal does not contain information about the status of payment for sales:

This information can only be obtained from the statement:

Advances and repayment of customer debts

As an example, we will take the receipt of non-cash funds with and without indicating the basis for payment. As you can see, a line without specifying the settlement object will be assigned to “Advance”.

Advance and debt payment

Based on the movements of the document, you can see how part of the amount went to closing the debt, and the other part went to the advance.

Advance and payment of debt in the accumulation register “Settlements with customers”

Mutual settlements with suppliers

This time we’ll complicate the example a little - first, let’s enter an advance payment to the supplier:

In this case, we will leave the calculation object empty:

In purchasing reports we will use the Statement of settlements with suppliers

:

Now we create an order for the supplier (we will conduct mutual settlements by order). To assign payment to it, you need to offset the advance:

In the payment offset assistant window that opens, find the advance payment, adjust the offset amount if necessary, and click Offset/Transfer advance payment

:

Now we see that the advance has been credited, click Execute

at the top of the form:

As a result, the order becomes fully paid:

Now in the report you can see that part of the advance payment remained undistributed, and for the order, in order to bring the calculations to zero, it remains to issue an invoice:

Debt offset

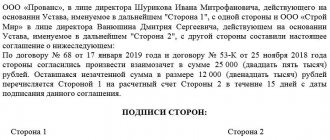

In the case where there are both receivables and payables at the same time, debt offset is often used to compensate one debt at the expense of the other.

We already have one operation automatically registered in our program - this is a reflection of the fact of offset of advances:

Those. The program transferred the receivables (the supplier's debt to us) for the payment order to the accounts payable (our debt to the supplier) for the supplier's order:

There is a note about automatic creation in the comment:

Here is a list of transactions for which offset can be used:

Settlement between counterparties

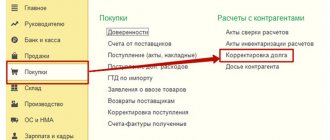

Settlement in 1C 8.3 is carried out using the standard document “Debt Adjustment”. You can find it in the “Sales” or “Purchases” menu sections, in both cases in the “Settlements with counterparties” subsection, “Debt Adjustment” item:

Let's consider filling out the document.

The most important is the “Type of operation” field. Here you need to select the correct type of adjustment from the drop-down box.

Let's look at how, depending on the specified type of operation, the filling of the lower fields will change. Click, the program offers you to choose: offset of advances, offset of debt, transfer of debt, write-off of debt and other adjustments.

We choose the first type - advance payment. In the second field “Credit advance payment” you can select either the buyer or the supplier.

Depending on your choice, indicate in the “On account of debt” field to whom the advance is credited: our organization to the supplier/our organization to a third party or the buyer to our organization/third party to our organization:

The next type of operation is debt offset, which is filled out in the same way as advance payment offset. In the second field we indicate to whom: the buyer or the supplier. In the third we also choose: our organization in front of the supplier/buyer or our organization in front of a third party.

If you select the type of operation “Transfer of debt”, then the “Transfer” field appears active and from the drop-down window we select where: buyer’s debt, buyer’s advances, supplier’s debt, supplier’s advances.

Next, select the “Debt write-off” type. The “Write off” field is filled in similarly to the previous type: buyer’s debt, buyer’s advances, supplier’s debt, supplier’s advances.

And the last type of operation is “Other adjustments”, here it is possible to perform absolutely any action that concerns mutual settlements. Using this item, you can arrange all four mutual settlements described earlier. To do this, you need to fill in the fields with the necessary data.

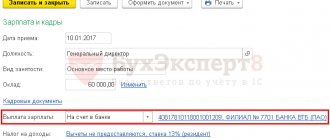

We will transfer debt from one counterparty-buyer to another. Fill in the fields:

- Type of operation – debt transfer;

- Transfer – buyer’s debt;

- We skip the number and date, since they are generated automatically after posting the document;

- Buyer (debtor) – select the counterparty from whom the debt needs to be transferred;

- The new buyer is the counterparty to whom we transfer the debt.

Now click the “Fill” button and select “Fill with mutual settlement balances”:

The tabular part has been filled in based on the entered information. The contract for the counterparty, the settlement document, the amount and the accounting account are displayed.

You need to fill out the line “New contract”, that is, select the contract to which you are transferring the debt, and post the document. Now you need to print out the “Act of Mutual Settlement” using the button in the top panel and submit it for signature.

You can view the transfer of debt in the balance sheet. It went away from one counterparty, and from another it formed: