Composition of R&D costs and the procedure for their recognition

In Art. 262 of the Tax Code of the Russian Federation establishes regulations for accounting for R&D costs. These include:

- Depreciation of fixed assets and intangible assets (excluding buildings and structures) involved in these developments, calculated for full months.

- Payment for the labor of employees who took part in R&D. The list of these expenses is limited by paragraphs. 1, 3, 16 and 21 art. 255 of the Tax Code of the Russian Federation and includes:

- salary according to tariffs (salaries);

- additional payment to employees for night work, multi-shift work, combination of positions, as well as for work on holidays and weekends, overtime service, hazardous working conditions;

- the employer's costs caused by the conclusion of contracts for compulsory or voluntary insurance of development participants, in the manner prescribed by clause 16 of Art. 255 Tax Code of the Russian Federation;

- payments under GPC agreements to persons participating in R&D.

IMPORTANT! If employees were employed both in R&D and in other areas of activity, then salary costs are recognized as R&D expenses in proportion to the time spent specifically on research.

- Expenses associated with the acquisition of material assets for carrying out research and experiments:

- Costs caused by third-party work in which the organization acts as a customer.

- purchase of materials, necessary tools, devices, accessories;

- purchase of devices and equipment involved in R&D;

- purchase of special clothing, personal and general protective equipment;

- expenses for fuel, water and energy of all types used in this activity.

These costs are recognized in tax accounting as part of other expenses in the reporting period when the work is completed, even if the result of all work is negative (the research was not useful in practice).

- Other costs directly related to research, in an amount not exceeding 75% of the remuneration of workers involved in it.

Clause 5 Art. 262 of the Tax Code of the Russian Federation allows you to take into account other costs associated with R&D, in part exceeding 75%, as part of other expenses for calculating income tax in the period of completion of R&D.

That is, in fact, it is allowed to take into account all costs as part of others, the main thing is that they are associated with conducting research.

IMPORTANT! It is imperative to approve in the accounting policy which expenses for research and development can be taken into account as expenses directly related to R&D.

The results of R&D that ultimately yield an intangible asset are included in costs in one of 2 ways, which must be specified in the accounting policy:

- depreciation calculation;

- inclusion in other expenses for 2 years.

To evenly account for R&D costs, many companies create a reserve for future costs and subsequently write off all emerging expenses against this reserve.

If any costs associated with a new intangible asset accepted for accounting have already been previously written off as expenses, then they are not restored and are not included in the price of the intangible asset (clause 9 of Article 262 of the Tax Code of the Russian Federation).

- The company can create reserve funds for R&D. The costs of their creation should not exceed 1.5% of revenue.

If you have access to ConsultantPlus, check whether you have correctly taken into account R&D costs in tax accounting. If you don't have access, get a free trial of online legal access.

What is included in R&D expenses?

R&D stands for “scientific research and development.” They are intended to form a new or improved technology, to invent a new type of product with more advanced characteristics. R&D expenditures can be directed towards finding improved methods of organizing production or implementing management functions.

Question: Is it possible to recognize R&D expenses, the results of which began to be used after the expiration of the period allotted for their write-off (clause 2 of Article 262 of the Tax Code of the Russian Federation)? View answer

The composition of expenses incurred by an institution in connection with ongoing R&D is determined by Art. 262 Tax Code of the Russian Federation:

- Depreciation charges for fixed assets and intangible assets involved in the work.

- Compensation for personnel involved in research activities or operations to develop new designs.

- Material costs allocated for R&D. These include the purchase of exclusive rights to the results of inventive activity, to the resulting utility models or unique industrial designs. The transfer of rights is carried out through an alienation agreement. It is allowed to allocate expenses for the acquisition of rights to use intellectual property.

- Other expense transactions that are directly related to R&D. The legislation allows them to be included in the amount of costs for research and development activities not in full, but in the amount of up to 75% of the total amount of expenses incurred.

- Payment of invoices under R&D contracts.

NOTE! For the group of labor costs, their inclusion in R&D is possible if the personnel were engaged in research and development work. If these workers are involved in other tasks, accrued earnings are allocated to various types of expenses in proportion to the time worked at the facilities.

Question: Is it possible to recognize R&D expenses according to the new rules if the taxpayer has already begun to take them into account in the previously existing procedure (paragraphs 2 and 3 of paragraph 2 of Article 262 of the Tax Code of the Russian Federation)? View answer

Recognition of R&D costs at 1.5%

The Decree of the Government of the Russian Federation “On approval of the list...” dated December 24, 2008 No. 988 approved the register of scientific research and development in specific areas, the real costs of which the organization can take into account as part of other expenses of the reporting period in which they were completed, with increasing factor 1.5. Organizations conducting R&D in areas from the government's list, at the end of the year in which these developments are completed, together with the declaration, submit a report on the R&D carried out to the tax office.

Increasing factor

Some R&D expenses can be accounted for using a factor of 1.5. Their list is established by Decree of the Government of the Russian Federation of December 24, 2008 No. 988. If there are such expenses, from January 1, 2012, you must submit to the tax inspectorate a report on the research (development) performed, in respect of which the inspectorate can order an examination. According to the Ministry of Finance, the report must comply with the general requirements established by the national standard for the structure of the preparation of scientific and technical reports (Letter dated August 7, 2013 No. 03-03-10/31889). This report is submitted along with the declaration for the year in which the R&D was completed.

If the report is not submitted to the inspection, then the corresponding expenses are taken into account as part of other expenses in the amount of actual expenses.

If R&D began before January 1, 2012, then the amounts of expenses for them are included in other expenses in the reporting (tax) period in which they were carried out, in the manner in force in 2011. In this case, there is no need to submit a report (clause 11 of Article 262 of the Tax Code of the Russian Federation).

The list approved by Resolution No. 988 includes scientific research and development in six areas of scientific activity. Let's present them in detail.

I. Nanosystems industry:

1. Computer modeling of nanomaterials, nanodevices and nanotechnologies;

2. Nano-, bio-, information, cognitive technologies;

3. Diagnostic technologies for nanomaterials and nanodevices;

4. Technologies of nanodevices and microsystem technology;

5. Technologies for the production and processing of structural nanomaterials;

6. Technologies for obtaining and processing functional nanomaterials;

II. Information and telecommunication systems:

1. Technologies for access to broadband multimedia services;

2. Technologies of information, control, navigation systems;

3. Technologies for creating electronic components and energy-efficient lighting devices;

4. Technologies and software of distributed and high-performance computing systems;

III. Life Sciences:

1. Biocatalytic, biosynthetic and biosensor technologies;

2. Genomic, proteomic and post-genomic technologies;

3. Cellular technologies;

4. Bioengineering technologies;

5. Biomedical and veterinary technologies;

6. Technologies for reducing losses from socially significant diseases;

IV. Rational environmental management:

1. Technologies for monitoring and forecasting the state of the environment, preventing and eliminating its pollution;

2. Technologies for search, exploration, development of mineral deposits and their extraction;

3. Technologies for preventing and eliminating natural and man-made emergency situations;

V. Transport and space systems:

1. Technologies for creating high-speed vehicles and intelligent control systems for new types of transport;

2. Technologies for creating new generation rocket, space and transport equipment;

VI. Energy efficiency, energy saving, nuclear energy:

1. Basic technologies of power electrical engineering;

2. Technologies of new and renewable energy sources, including hydrogen energy;

3. Technologies for energy-efficient production and energy conversion using fossil fuels;

4. Technologies for creating energy-saving systems for transportation, distribution and use of energy;

5. Technologies of nuclear energy, nuclear fuel cycle, safe management of radioactive waste and spent nuclear fuel.

R&D accounting

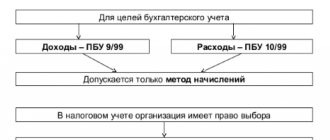

PBU 17/02 is devoted to accounting for these expenses (approved by order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 115n).

The costs of conducting research that yielded a positive result are accumulated in accounting in account 08 “Investments in non-current assets” after the month when the results of these studies begin to be applied. To accept these costs the following conditions must be met:

- the amount of costs is known;

- all costs are documented;

- the results of R&D are effective and will bring benefits in the future;

- R&D results can be demonstrated.

After all expenses for research are taken into account on account 08, they are transferred to account 04 and accounted for either as intangible assets, if the rights to the results are legally formalized, or as R&D costs. The cost of intangible assets is written off through depreciation. The cost of R&D expenses is transferred to cost accounts monthly after being accepted into account 04. The write-off period is established in the accounting policy; it should not exceed 5 years. Write-off occurs either using the straight-line method or in proportion to the volume of production.

If at least one of these points is not met, expenses for research and development are taken into account as part of other expenses in account 91.

Costs specifically as R&D expenses are recognized in accounting if all the above conditions for their recognition according to PBU 17/02 are met.

ConsultantPlus experts in the Guide to Information Security “Correspondence of Accounts” made a selection of consultations on accounting for R&D costs. Study the material by getting trial access to the K+ system for free.

Read more about this in the article “The list of R&D expenses will be expanded.”

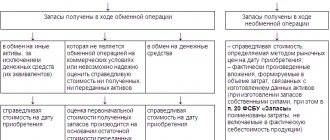

Cost recognition procedure

When calculating income tax, R&D costs may be reflected as follows:

- intangible assets;

- other costs associated with production and sales;

- costs associated with production and sales.

This is stated in Article 262 of the Tax Code of the Russian Federation.

If, as a result of R&D, a sample is obtained for which the organization plans to obtain exclusive rights, then the cost of R&D at the organization’s choice is taken into account as part of:

- intangible assets;

- other expenses.

The chosen option must be fixed in the accounting policy for tax purposes.

If exclusive rights to R&D results are subject to mandatory state registration, take them into account as part of intangible assets (or other expenses) from the date of such registration (clause 3 of Article 257 and clause 9 of Article 262 of the Tax Code of the Russian Federation). A similar point of view is reflected in letters of the Ministry of Finance of Russia dated March 23, 2015 No. 03-03-10/15777 (brought to the attention of tax inspectorates by letter of the Federal Tax Service of Russia dated May 20, 2015 No. GD-4-3/8484) and dated April 1 2013 No. 03-03-10/10294. For example, exclusive rights to an invention, utility model and industrial design are subject to mandatory state registration (Part 1 of Article 1232 and Article 1353 of the Civil Code of the Russian Federation). And such a right is certified by the presence of a patent by the copyright holder (Article 1354 of the Civil Code of the Russian Federation).

R&D expenses previously included in other expenses in accordance with Chapter 25 of the Tax Code of the Russian Federation are not restored and are not included in the initial cost of intangible assets.

This procedure is established by paragraph 9 of Article 262 of the Tax Code of the Russian Federation.

An example of how R&D expenses included in intangible assets are reflected in accounting and taxation

Alpha LLC carries out R&D on its own, as a result of which it plans to obtain a patent for the invented utility model and use it to generate income. The organization pays income tax monthly using the accrual method.

The work began in January and was completed in March.

The cost of the work amounted to 100,000 rubles, including:

- in January – 40,000 rubles;

- in February – 40,000 rubles;

- in March – 20,000 rubles.

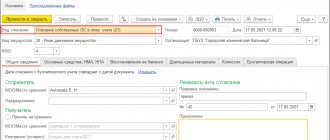

To account for R&D as part of intangible assets, the “Masters” accountant opened a subaccount “R&D Expenses” to account 04.

Every month from January to March, the accountant reflected R&D expenses by posting:

Debit 08 subaccount “R&D expenses” Credit 70 (69, 68, 10, 02...) – reflects R&D expenses.

In April, Alpha received a patent confirming that it owns exclusive rights to the invented model. In the same month, the organization began to use the utility model in production. To account for the received patent, in April the accountant opened a card in form No. NMA-1. In the same month, the accountant formed the initial cost of the intangible asset in the amount of 103,000 rubles, including:

- R&D expenses – 100,000 rubles;

- expenses associated with patent registration - 600 rubles. (fee for filing an application for a utility model patent) and 2,400 rubles. (fee for registering a utility model and issuing a patent).

In tax accounting, the value of an intangible asset is formed in the same amount.

In April, the following entry was made in Alpha’s accounting records:

Debit 04 Credit 08 subaccount “R&D expenses” – 103,000 rubles. – exclusive rights to a utility model are taken into account as part of intangible assets.

Regardless of the results obtained, R&D expenses can be included at a time in other expenses in the reporting (tax) period in which the research or development (their individual stages) is completed.

If a third-party organization was involved in performing R&D, then upon completion of the stages or work as a whole, the customer and the contractor sign an acceptance certificate.

This is stated in paragraphs 4 and 5 of Article 262 of the Tax Code of the Russian Federation.

For organizations using the cash method, R&D costs must be paid (Article 273 of the Tax Code of the Russian Federation).

An example of how R&D expenses that have yielded positive results are reflected in accounting and taxation. The organization applies a general taxation system. In accounting, R&D expenses are written off in proportion to the volume of products produced

LLC "Proizvodstvennaya" is the customer under the contract for R&D on laser processing of the cutting edge of a milling cutter, leading to an increase in the number of parts processed by it. The contractual cost of the work is 1,180,000 rubles, including VAT – 180,000 rubles. In January, the customer accepted the work performed by the contractor and paid for it. In the same month, the Scientific and Technical Council (STC) of “Master” issued a conclusion on the positive result of R&D. The accounting policy of an organization establishes a method for writing off R&D expenses in proportion to the volume of output (work, services). The reporting period for income tax is a month. Income and expenses for profit tax purposes are determined using the accrual method.

The period for applying a positive R&D result, determined by the organization, is 35 months. Every month, the “Masters” milling shop produces 300 units of products. In just 35 months, 10,500 units were produced.

To account for R&D as part of intangible assets, the “Masters” accountant opened a subaccount “R&D Expenses” to account 04.

The amount of R&D expenses that the organization writes off monthly in accounting is 28,571 rubles. (RUB 1,000,000 × 300 units: 10,500 units).

In January, the following entries were made in the organization’s accounting:

Debit 08 Credit 60 – 1,000,000 rub. (RUB 1,180,000 – RUB 180,000) – R&D expenses performed by the contractor are reflected;

Debit 19 Credit 60 – 180,000 rub. – VAT on work performed is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 180,000 rubles. – accepted for VAT deduction;

Debit 60 Credit 51 – 1,180,000 rub. – paid for the work performed;

Debit 04 subaccount “R&D expenses” Credit 08 – 1,000,000 rub. – R&D expenses are taken into account, the results of which are used in the production of products.

In tax accounting, the accountant writes off the entire amount of R&D expenses (RUB 1,000,000) in January.

Due to differences in the recognition of R&D expenses in accounting and taxation in accounting, a taxable temporary difference arises, with which the deferred tax liability must be calculated (clauses 12, 15 of PBU 18/02):

Debit 68 subaccount “Calculations for income tax” Credit 77 – 200,000 rubles. (RUB 1,000,000 × 20%) – deferred tax liability is reflected.

R&D expenses are written off in accounting starting in February. As R&D expenses are recognized (starting in February over a period of 35 months), the accountant will write off the deferred tax liability.

When writing off the cost of R&D as an expense, the accountant makes monthly entries:

Debit 20 Credit 04 “R&D expenses” – 28,571 rubles. – the part of R&D expenses attributable to the current month is included in the cost structure;

Debit 77 Credit 68 subaccount “Calculations for income tax” – 5714 rubles. (RUB 28,571 × 20%) – the deferred tax liability for the current month is written off.

If the work is stopped due to the fact that it was found to be inexpedient, the completion of the work is documented.

An example of reflection in accounting and taxation of R&D expenses that did not produce a positive result

In January, Proizvodstvennaya LLC began carrying out development work with the aim of manufacturing a new sample of the product necessary for the production of products.

The organization carried out the work using its own design bureau. In April, the work was stopped due to its futility. The cost of work from January to April was 100,000 rubles. Of them:

- in January – 40,000 rubles;

- in February – 30,000 rubles;

- in March – 20,000 rubles;

- in April – 10,000 rubles.

From January to April inclusive, the accountant reflected R&D expenses by posting:

Debit 08 Credit 70 (68, 69, 10...) – R&D expenses are reflected.

Work was stopped in April. In the same month, the accountant wrote off the cost of R&D as other expenses:

Debit 91-2 Credit 08 – 100,000 rub. – R&D expenses that did not produce a positive result are included in other expenses.

In tax accounting, R&D expenses are recognized as other expenses in the reporting period when they were completed (regardless of the results obtained). Therefore, the amount of R&D expenses in accounting and tax accounting is the same.

An organization's expenses for contributions to R&D financing funds are recognized for tax purposes in the reporting (tax) period in which they were incurred (clause 6 of Article 262 of the Tax Code of the Russian Federation).

Results

More and more organizations are involved in research and development with the goal of entering the market with new technologies or products and, accordingly, increasing profits. The regulation for recognizing R&D expenses in tax accounting was approved by Art. 262 of the Tax Code of the Russian Federation, and in accounting - PBU 17/02.

Sources:

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation “On approval of the list...” dated December 24, 2008 No. 988

- PBU 17/02, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 N 115n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

An example of typical entries for accounting for R&D at an enterprise

Strela LLC independently carried out R&D in January 2016. The useful life of the results is 2 years. The costs it incurred in doing so are:

- materials RUB 120,000;

- depreciation of equipment and fixed assets RUB 5,000;

- wages of employees performing R&D, 73,000 rubles;

- contributions to extra-budgetary funds 22,000 rubles;

In this case, the accountant must generate the following entries presented in the table below.

| Debit | Credit | Operation description |

| 08 | 02 | the amount of depreciation of equipment and fixed assets was written off |

| 08 | 10 | the amount of materials used is written off |

| 08 | 70 | the amount of wages of employees performing R&D was written off |

| 08 | 69 | the amount of contributions to extra-budgetary funds has been written off |

After all expenses incurred are collected in account 08 and the R&D result begins to be used in the production process, for example, in March 2016), the following entry must be made:

Debit 04 Credit 08 – expenses related to R&D were incurred in the amount of RUB 9,166.67. (RUB 220,000 / 24 months)

In tax accounting, expenses will be taken into account in a slightly different way:

220,000 rub. / 12 months = 18,333.33 rub.