Natalia, hello!

That's right - accounts 09 and 77 have their own analytics in 1C.

How you can and should check yourself after each Month Closing in the part of PBU 18/02: Reports – SALT – Show settings – select only BP on the Indicators tab. This is the base for the balance on account 09 and account 77. That is, base x 20% = the result on account 09 and account 77 in the context of specific analytics for the subconto Types of assets and liabilities.

Which accounts form the basis for the corresponding analytics on accounts 09 and 77: Non-current assets - 08 Finished products - 43 Accounts receivable - 62, 76 Income investments in tangible assets - 03 - 02.02 Deferred income - 98 Distribution costs - 44 Indirect production costs - 26 , 25 Accounts payable – 60, 76 Exchange differences for settlements in foreign currency – 60, 62, 76 Exchange differences for settlements in monetary units – 60, 62, 76 Materials – 10 Work in progress – 20, 23, 28, 29 Intangible assets – 04 – 05 Equipment – 07 Fixed assets – 01 – 02 Estimated liabilities and reserves – 96 Semi-finished products – 21 Deferred expenses – 97 Provisions for doubtful debts – 63 Goods – 41 Goods shipped – 45 Loss of the current period – 99.01 Financial investments – 58, etc. d.

If for some reason the cost of inventory in accounting and accounting system is different and you entered balances in 1C, then you should have entered different amounts in accounting and accounting system for account 10 and a temporary difference (20%) in account 09 (77) from analytics Materials.

Account 77 of accounting is a passive account “Deferred tax liabilities”, collects information on the presence and movement of deferred tax liabilities. Using standard postings and practical examples, we will consider the specifics of using account 77 in accounting.

How deferred tax liabilities arise

Deferred tax liabilities arise when permanent or temporary differences arise as a result of different procedures for recognizing income and expenses (profit/loss) in accounting and tax accounting.

Deferred tax liabilities are accounted for in an amount equal to the product of taxable temporary differences and the income tax rate at the reporting date.

Taxable temporary differences in the formation of taxable profit/loss form deferred income tax, which should increase the amount of income tax in subsequent reporting periods when paid to the budget.

Let's look at an example of how deferred tax liabilities are formed.

Let's say from January 2022. JSC "Zern" commissioned new equipment. Its cost was 240,000 rubles, its useful life was four years.

The procedure for recognizing expenses in accounting and tax accounting is as follows:

- Accounting - linear depreciation method, that is, for February = 5,000 rubles, the residual value as of March 1 was 235,000 rubles.

- Tax accounting is a non-linear depreciation method, that is, for February = 10,000 rubles, the residual value as of March 1 was 230,000 rubles.

- Therefore, the taxable temporary difference is RUB 5,000.

What is deferred tax liability?

If expenses in accounting appear later and in greater quantities than in tax accounting, while at the same time income is determined at an earlier date, then conditions arise in the organization for the appearance of IT.

Factors influencing the discrepancy between the calculation of income and expenses in tax and accounting:

- use of legal a person using the cash method when accruing tax accounting, that is, receiving revenue upon shipment of goods before receipt of actual payment;

- differences in calculating depreciation of property.

The resulting taxable temporary differences lead to future tax increases.

The following formula applies to the deferred tax liability: taxable temporary difference * current income tax rate.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

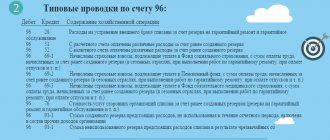

Postings to account 77 “Deferred tax liabilities”

Correspondence 77 accounts and entries for accounting for deferred tax liabilities are shown in the table below:

| Dt | CT | Wiring Description | A document base |

| 68 | 77 | Deferred tax reflection | Accounting certificate, Advance payment, Declaration |

| 77 | 68 | Reduction/full repayment of deferred tax reflected | Accounting certificate, Tax registers, Bank statement |

| 99 | 77 | Deferred tax liability written off | Accounting certificate, Tax registers |

Examples of transactions and postings on account 77

Let's look at an example:

- In the second quarter of 2016, Polor LLC (cash method) shipped goods to Vex LLC in the amount of 370,000 rubles, excluding VAT, and received payment of 210,000 rubles, excluding VAT.

- In the third quarter of 2016, the buyer fully repaid its debt to Polor LLC.

- In July of the same year, Polor LLC sold the machine, the accrued depreciation on which amounted to 46,000 rubles in accounting, and 52,000 rubles in tax accounting.

Let's do the calculation:

- income in the accounting records of Polor LLC will be recognized in the amount of 370,000 rubles, and in the tax accounting - in the amount of 210,000 rubles;

- taxable temporary difference – RUB 160,000.

The deferred tax liability for account 77 is reflected in the following entries:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 51 | 62 | 210 000 | Partial payment from Veks LLC is reflected | Bank statement |

| 62 | 90.01 | 370 000 | Reflected sales revenue | Packing list |

| 68.04.2 | 77 | 32 000 | Reflection of the increase in tax liability based on the results of the 2nd quarter of 2016. | Accounting certificate, Advance payment, Declaration |

| 51 | 62 NVR | 160 000 | Reflected payment from LLC "Vex" | Bank statement |

| 77 | 68.04.2 | 32 000 | Deferred tax liability settled | Accounting certificate, Tax registers, Bank statement |

| 77 | 99 | 1 200 | Reflection of the write-off of the amount of deferred tax liability (machine) | Accounting certificate, Tax registers |

Example of IT reflection

Let’s assume that a certain business entity sold products to another, the cost of which was 185,000.0 rubles excluding VAT. Only part of the funds in the amount of 125,000.0 rubles was received from the customer. The company that sold the goods uses the cash method when calculating fiscal obligations. The remaining part of the debt was transferred only in the next fiscal period. Thus, the organization acting as a seller in this transaction displayed the following accounting entries:

1) Dt 62

Kt 90 – 185,000.0 rubles, revenue from the sale of goods;

2) Dt 51

Kt 62 – 125,000.0 rubles, accounting of received funds;

3) Dt 68

Kt 77 – RUB 12,000.0, reflected by IT.

In the next reporting period, when the remaining balance for the products was paid off, the following entries were made:

1) Dt 51

Kt 62 – RUB 60,000.0, receipt of final payment;

2) Dt 77

Kt 68 – 12,000.0 rubles, accounting for redeemed IT.

Account 77 » Deferred tax liabilities Postings and Examples

Chart of Accounts Income Tax calculation Income Tax News Tax News

Main items Postings to Fixed Assets Leasing Accounting Account 09 Account 99

Account 77 “Deferred tax liabilities”

Posting Calculation and Examples

Account 09 "Deferred tax asset"

Account 77 of accounting, “Deferred tax liabilities,” collects information on the presence and movement of deferred tax liabilities that arise when calculating income taxes.

Deferred tax liabilities arise when permanent or temporary differences arise as a result of differences in the recognition of income and expenses in accounting and tax accounting.

Deferred tax liabilities (DTL) are accounted for in an amount equal to the product of taxable temporary differences and the income tax rate as of the reporting date:

IT = NVR x 20%

Taxable temporary differences (TDT) when forming profit/loss form deferred income tax, which should increase the amount of income tax in the next period.

Postings:

| No. | Debit | Credit | |

| 1 | Reflects part of the amount of previously recorded IT written off to increase the income of the reporting period | 77 | 68 |

| 2 | Reflects part of the amount of previously recorded IT written off to increase the conditional expense of the reporting period | 77 | 68 |

| 3 | Reflects the amount of IT, which reduces the amount of the conditional expense of the reporting period | 68 | 77 |

| 4 | Reflects the amount of IT, which reduces the amount of conditional income of the reporting period | 68 | 77 |

| 5 | Write-off of IT (accounting certificate) | 99 | 77 |

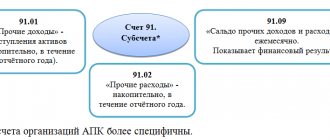

IT (account 77) corresponds with two accounting accounts - 68 and 99. The received entries reflect the following results:

Dt 68 - Kt 77 - deferred tax, which reduces the amount of income or expense.

Dt 77 - Kt 68 - repayment of deferred tax, formed when income tax is calculated at the end of the reporting period.

Dt 77 - Kt 99 - IT is canceled upon disposal of the asset or circumstance that forms it.

Examples of transactions and postings on account 77

Example 1.

- In the second quarter of 2022, Supplier LLC (operating on a cash basis) shipped goods to Buyer LLC in the amount of RUB 370,000. without VAT and received payment - 210,000 rubles. without VAT.

- In the third quarter of 2022, the buyer fully repaid its debt to Supplier LLC.

Calculation:

- income in the accounting records of Supplier LLC will be recognized in the amount of 370,000 rubles, and in the tax accounting - in the amount of 210,000 rubles;

- taxable temporary difference = RUB 160,000.

IT on account 77 is reflected by the following entries:

| Dt | CT | Transaction amount, rub. | Wiring Description | Base |

| 210 000 | Partial payment from the buyer is reflected | Bank statement | ||

| 370 000 | Reflected sales revenue | Packing list | ||

| 32 000 (370,000 – 210,000) x 20% income tax | Reflection of the increase in tax liability based on the results of the 2nd quarter of 2016. | Accounting certificate, Advance payment, Declaration | ||

| 62 Cash Time Time | 160 000 | Payment from buyer reflected | Bank statement | |

| 32 000 | Deferred tax liability settled | Accounting certificate, Tax registers, Bank statement |

What is IT

If expenses in accounting appear later and in greater quantities than in tax accounting, while at the same time income is determined at an earlier date, then conditions arise in the organization for the appearance of IT.

What affects the discrepancy between the calculation of income and expenses in tax and accounting:

— the company’s use of the cash method when accruing tax accounting, that is, receipt of revenue upon shipment of goods before receipt of actual payment;

— differences in calculating depreciation of fixed assets.

The resulting taxable temporary differences (TDT) lead to an increase in tax in the next period.

Example 2.

Supplier LLC sold goods to Buyer LLC for the amount of 170,000 rubles (excluding VAT).

Payment from the buyer was received in the amount of 100,000 rubles.

Supplier LLC uses the cash method when determining tax. The remaining part of the debt was transferred the following year.

At the end of the reporting period, the accountant of Supplier LLC makes the following entries:

Dt 62 - Kt 90 - 170,000 rubles - revenue in accounting for shipped goods;

Dt 51 - Kt 62 - 100,000 rubles - payment from Buyer LLC;

Dt 68 - Kt 77 - 14,000 rubles (debt 70,000 x income tax rate of 20%) - IT is reflected.

When reporting, the amount of 14,000 rubles is reflected in the balance sheet as a deferred income tax liability (IT).

In the subsequent period after closing the debt, the accountant will make the following entries:

Dt 51 - Kt 62 - 70,000 rubles - final payment received from the buyer;

Dt 77 - Kt 68 - 14,000 rubles - IT was repaid.

Fixed Assets

Accrual of depreciation of fixed assets leading to the formation of capital assets

| Initial data | Reflection in accounting | Reflection in tax accounting |

| Purchase of OS, initial cost | 960,000 rubles | 960,000 rubles |

| Depreciation method | Linear | Nonlinear |

| Depreciation group | 3 group | 3 group |

| Accrued depreciation | 20,000 rubles (960,000: 4 years: 12 months) | 53,760 (960,000 x 5.6:100) |

Sometimes there is a discrepancy between actual and planned profits at the moment. The income tax accrued on the income actually received does not coincide with the amount indicated in the tax reporting due to the time difference between the period of accrual and the period of actual payment. The transaction data for account 77 is reflected.

Account 77: its correspondence

IT, formed on account 77, corresponds with two accounting accounts - 68 and 99. The received entries reflect the following results:

Dt 68 - Kt 77 - deferred tax, which reduces the amount of income or expense.

Dt 77 - Kt 68 - repayment of deferred tax, formed when income tax is calculated at the end of the reporting period.

Dt 77 - Kt 99 - IT is canceled subject to the disposal of the asset or the circumstance that previously formed it.

Accounting itself in account 77 should be kept separately for each type of asset or liability that affects the appearance of deferred tax.

Features of account 77

Account 77 is used by income tax payers. It accumulates amounts that must be paid in subsequent tax periods. The term “deferred tax liability” refers to accrued but unpaid income tax, which will actually be transferred after filing reports for a certain period. The deferred tax amount is calculated as temporary accounting differences multiplied by the current tax rate. The amount of accruals must correspond to the data indicated in the tax reporting.

Accounting account 77 is a passive account. The credit of the account takes into account the amount of deferred income tax liabilities, and the debit takes into account the decrease in the amount due to tax payments.

The right not to use this account arises for organizations exempt from paying income tax: organizations using the simplified tax system, UTII, firms related to Skolkovo. It is better to secure this right by an internal local act of the organization.

Example of using account 77

in June 2022, she purchased and began using new equipment worth 120,000 rubles. The useful life of the equipment is 2 years. The equipment belongs to the 3rd depreciation group. Then for July 2022:

- depreciation for fixed assets in accounting will be 5,000 rubles;

- depreciation in tax accounting (non-linear method) will be 6,720 rubles.

The taxable temporary difference is 1,720 rubles. IT = 1720*income tax rate for the reporting period. Over time, depreciation figures in accounting will begin to exceed depreciation reflected in tax accounting. Consequently, the deferred tax liability will decrease.

The company chooses the method of calculating depreciation (linear or non-linear) independently. You can change the depreciation calculation method no more than once a year.

Account 77 – accounting entries

Account 77 reflects the movement of the amount of accrued income tax in correspondence with account 68. Subaccount 01 “Calculations for income tax” is opened to account 68. The tax amount is calculated in the current period and is included in expenses for the current period of time. It is carried out from the debit of account 68.01 to the credit of account 77. The documents on the basis of which data is entered into the account will be:

- tax return,

- accounting certificate-calculation.

On the debit of account 77, the amounts due for repayment of income tax in the current reporting period are posted. The amounts are posted to the credit of account 68.01. The debit is made on the basis of a payment order or bank statement.

In the case of writing off an asset on which tax has been charged, the posting will be made from the debit of account 77 to the credit of account 99. In this case, a sub-account “Write-off of deferred tax liability” is also opened to account 99.

Standard Accounting Entries

To accept the transferred tax debt for accounting purposes, it is necessary to derive a derivative of taxable temporary differences occurring during the reporting period and the current income tax rate.

The company's credit position, debiting account 68, shows the deferred amount of fiscal obligations, which reduces the amount of conditional expenses or income in the reporting period.

In the debit part of crediting 68 positions of the organization show a reduction or full repayment of deferred fiscal liabilities against the accrued income tax in the reporting period.

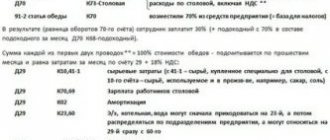

Account 77 – deferred tax liabilities, example

In the first quarter, the company sold a batch of building materials worth 420,000 rubles. According to the agreement, payment was made in two parts: the buyer paid 200,000 rubles immediately, and paid another 220,000 rubles in the second quarter. Used equipment was also sold, for which depreciation was charged in accounting records of 45,000 rubles, and for tax purposes 53,000 rubles. The amount of tax deferred for payment was 8,000 rubles.

Based on the terms of the agreement, the total amount will be 420,000 rubles, but the actual taxable base at the moment will be equal to 200,000 rubles - the amount paid by the buyer.

In the posting table it will look like this

| Dt | CT | Amount, rub. | Description | Accounting documents |

| 51 | 62 | 200 000 | The first part of the payment is reflected | Statement from the bank |

| 62 | 90.01 | 420 000 | Total revenue | Invoice |

| 68.04 | 77 | 52 000 | Tax increase for the reporting period of the 1st quarter | Declaration, advance payment, bank statement. |

| 51 | 62 | 220 000 | Final payment for goods | Statement from the bank |

| 77 | 68.04 | 52 000 | Repayment of tax amount | Bank statement, accounting certificate |

| 77 | 99 | 8000 | Writing off the amount of tax liability | Certificate from accounting department |

Let's summarize: accounting account 77 is an account that reflects the amounts of taxes planned for payment in the future, but taken into account when calculating the tax base for income tax.

Essence and meaning of 77 accounts

Position 77 is used by companies when it is necessary to reflect transactions on reserved tax liabilities. On this account, organizations show the amounts, so to speak, of transferred income tax, which contribute to the growth of the volume of fiscal obligations required to be paid to the budget during the period following the reporting period.

It should be noted that not all business entities use this account. It is required to apply, first of all, those who are registered as medium-sized businesses. In addition to those, position 77 is also used in accounting by companies that have chosen a simplified fiscal regime.

Systematization of accounting

07/24/2018 | no comments

Account 77 “Deferred tax liabilities” is used in the accounting of companies that calculate taxes in accordance with PBU 18/02 to display information about emerging deferred tax liabilities.

Account 77 in accounting is a highly specialized account, designed exclusively to concentrate information about all emerging debts to the budget in terms of taxation of the company's profits, the payment of which will be carried out in the future. These debts arise due to the occurrence of temporary differences.

Deferred tax liabilities mean that part of the income tax, the payment of which to the budget is transferred to subsequent transfers. That is, these are amounts determined by calculation, which will subsequently lead to an increase in tax, or compensation for previously underpaid debt. This value is determined as the quotient of the product of existing taxable temporary differences that arose or were settled in the reporting period by the income tax rate (20% in 2016-2017).

Temporary inconsistencies may appear in a company’s accounting in the following situations:

- Various methods have been recorded for calculating depreciation of existing equipment for accounting and tax accounting (for example, linear and non-linear methods).

- Different times for taking into account the company's revenue received.

- Inconsistency in the time of acceptance of calculated vacation pay, etc.

The company bought an expensive machine, the price is 1 million rubles, the useful life will be 12 years. The accounting policies record different methods for calculating depreciation; the difference between the calculations was determined to be 150 thousand rubles.

Registration

Since 2016, for tax accounting purposes, property with an original cost of more than 100,000 rubles is recognized as depreciable. This provision applies to facilities put into operation starting from January 1, 2016 (Federal Law of June 8, 2015 No. 150-FZ).

But in accounting, the value of the limit remained the same - 40,000 rubles. Assets with a value within the limit established in the organization’s accounting policy, but not more than 40,000 rubles per unit, can be reflected in accounting as part of inventories (MPI). This condition is a right, not an obligation of the organization. That is, objects up to 40,000 rubles can be taken into account in one of two ways: either as fixed assets or as inventories.

Unlike accounting, in tax accounting taxpayers are not given the right to independently set a value limit for depreciable property. That is, from January 1, 2016, for tax accounting purposes, an asset with an original cost of no more than 100,000 rubles cannot be depreciable property. However, since 2015, an organization has the right to recognize the cost of property that is not depreciable as part of material expenses for more than one reporting period, taking into account the period of its use or other economically feasible indicators, if it establishes this procedure in its accounting policy.

Thus, an organization can bring accounting and tax accounting closer together, provided that the accounting policy for tax accounting purposes provides for the same procedure for accounting for assets as in accounting.

Namely: if the organization provides in its accounting policy for tax accounting purposes the procedure for recognizing the property in question as part of material expenses for more than one reporting period, taking into account the period of its use or other economically justified indicators (in the same manner as in accounting), then in tax accounting the expenses will also be recognized monthly. There is no need to record any additional transactions in accounting.

But if you decide to include the cost of the purchased object in material expenses in full when putting it into operation, then a difference will arise between the procedure for recognizing expenses in accounting and tax accounting. Since when reflecting low-value fixed assets (up to 100,000 rubles) in tax accounting, the initial cost is written off immediately, and in accounting gradually through depreciation, the “tax” profit turns out to be less than the “accounting” profit. This means that the temporary difference is taxable.

In accordance with paragraph 12 of PBU 18/02, the occurrence of a taxable temporary difference leads to the appearance of a deferred tax liability (DTL) in the same reporting period. IT indicates a decrease in the amount of income tax in the current reporting period and an increase in income tax in the following reporting periods.

It is important to note that the organization does not accrue tax for each temporary difference that arises and does not reflect it separately in accounting, but determines their value based on the final data on the amount of taxable temporary differences formed during the reporting period (clause 15 of PBU 18/02).

Account 77 “Deferred tax liabilities” in accounting

The company's profit before tax is 700 thousand rubles, the taxable base, taking into account the discrepancy in depreciation charges, is 550 thousand rubles.

The base mismatch is temporary, because After 10 years, full depreciation will be carried out in both types of accounting.

The resulting transferred tax liability = 150 thousand rubles. * 20% = 30000.

Account 77 is passive. For the loan, the calculated amount to be transferred to the budget is displayed, which allows you to reduce the amount of the financial result of the reporting period, the obligation to pay is transferred to future payments. The debit of the account includes information about the reduction of transferred debts or their full repayment against the calculated income tax for a given period. Transactions are displayed in correspondence with the account. 68.

When disposal of fixed assets, the transferred tax liability calculated on it is written off from the company's records. The write-off occurs for the amount by which the tax base for profits of both the reporting and subsequent periods will not be changed (carried out in Dt99).

Since the account is highly specialized, a certain number of transactions are carried out on it. Account 77, according to the instructions to the Chart of Accounts, corresponds only with the account. 68 (accounting for taxes and fees) and 99 (profits and losses):

- Appearance of transferred tax liability in accounting:

- Movement of previously calculated amounts (for example, an increase in current tax by previously deferred debts):

- Cancellation of an existing tax liability as a result of equipment write-off:

Victor Stepanov, 2017-07-13

>Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

How account 77 is formed in accounting

You can calculate IT using the formula:

IT = HBP × C,

where: TVR is a temporary difference subject to tax;

C is the current tax rate on profit.

At the end of the billing period, NVRs create deferred amounts for payment. It is worth increasing the tax value on them for further payments.

Let's look at how account 77 is formed in accounting. A credit reflects deferred tax, leading to a decrease in deemed income or expenses in the quarter in which reporting is submitted, and a debit reflects the repayment of obligations by accrual for subsequent payment of tax for the same period. The account for deferred tax liabilities is a passive account.

Analytical accounting for account 77 is carried out by type of assets and liabilities.

Account 77 - Deferred tax liabilities - is involved in the following transactions:

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

- Dt 68 Kt 77 - accrual of deferred tax is recorded;

- Dt 77 Kt 68 - full or partial repayment of IT;

- Dt 77 Kt 99 - IT was written off upon disposal of the asset (object) for which the mentioned obligation was accrued.

What are tax differences

In order to take into account the mentioned differences in accounting, account 77 “Deferred tax liabilities” is used. To decide how to handle this aspect of accounting, you need to understand what taxable differences are.

They can be:

- Permanent.

- Temporary.

Permanent differences will never be used to calculate income taxes, which is why they are called permanent differences. They can occur for a number of reasons:

- expenses on property received free of charge are not recognized for accounting purposes;

- a loss carried forward to future periods can no longer be taken into account due to the expiration of the period.

Temporary taxable differences can be used to calculate income taxes in the current or future periods. The temporary difference arises due to certain differences between accounting and tax accounting:

- depreciation of fixed assets in tax is greater than in accounting due to different methods of calculation;

- the company credited the proceeds from the sale of goods, but did not actually receive any cash;

- The methodology for calculating interest on loans varies in accounting.

Note from the author! Temporary differences must be positive to be reflected in deferred receivables.

Temporary differences

Temporary differences are considered to be income or expenses that form an accounting profit or loss during one reporting period, and the tax base for income tax is taken from another or other periods.

Temporary differences can have different effects on the amount of profit or loss, depending on their nature and influence they can be classified:

Temporary differences with deduction

This type of difference means the creation of deferred income tax, which will lead to a decrease in the tax base in the next or subsequent reporting periods. In other words, this leads to the formation of OTA - a deferred tax asset. To bring accounting movements into order, an account (deferred tax assets) must be used.

When creating an accounting entry, the amount of income tax in the accounting period will approach this value only for the tax reporting period. In subsequent months, it will be possible to carry out full or partial repayment of OTA to reduce or increase conditional income and expenses.

Temporary tax differences

Taxable differences in the formation of profit and loss for the purpose of calculating income tax lead to the creation of IT (deferred tax liability). Using this method, the tax base in the reporting period is reduced, and for subsequent periods it will increase due to the transfer of payment.

To put accounting entries in order when it moves, an accounting account (deferred tax liabilities) is used.

In analytical accounting, each temporary difference must be taken into account individually depending on the group of assets or liabilities. Simply put, all deferred tax liabilities cannot be aggregated into one single netting.

How are liabilities accounted for?

IT accumulations are formed according to the product formula:

Temporary differences * income tax rate in%.

In other words, liabilities (abbreviated as IT) appear if expenses are accepted later in accounting. Income, on the contrary, is recognized earlier. Therefore, they can be considered debt.

How is IT formed?

For example, an organization calculates depreciation in accounting using a linear method, but in tax accounting using a non-linear method. Let’s say a company bought a fixed asset “High-voltage line” worth 200,000 rubles. Since it costs more than 100,000, it is legally subject to depreciation in tax accounting, according to Art. 256 Tax Code of the Russian Federation.

According to the OKOF directory, according to which organizations are required to determine depreciation periods, high-voltage lines are classified as the 10th depreciation group, which means that the useful life is set at 361 months (30 years * 12). Since accounting uses the straight-line method, depreciation is calculated as follows:

200,000 / 361 months = 554.02.

This means that 554.02 rubles of depreciation charges will be written off monthly from the cost of the object. In turn, the 10th group assumes a monthly depreciation rate of 0.7% under Article 259.2 of the Tax Code of the Russian Federation:

200 000 * 0,7% = 1 400.

This means that every month depreciation deductions in the amount of 1,400 rubles are written off in tax accounting.

| Data | Accounting | Tax accounting |

| Purchasing an OS, cost | 200 000 | 200 000 |

| Method of calculating depreciation | Linear | Nonlinear |

| Depreciation group | ||

| Formula for calculating depreciation | 200,000 / 361 months | 200 000 * 0,7% |

| Depreciation accrued | 554,02 | 1 400 |

Thus, you can find the temporary taxable difference:

1,400 - 554.02 = 845.98 rubles.

The difference amounts will be credited to the 77th ONO account as follows:

845.98 * 20% = 169.20 rubles,

where 20% is the total income tax rate, taking into account the federal and regional shares. In this case, the following wiring should occur:

Debit 68.4 “Calculations for income tax” Credit 77 - 169.20 rubles.

Note from the author! The income tax rate and distribution by shares are regulated by law depending on the type of activity and the region of residence of the organization.

Change in deferred liabilities

According to the Chart of Accounts, adopted by law, movements in account 77 are strictly prescribed within certain limits. Operations on it can be performed to increase or decrease the indicator.

When IT is completely repaid or reduced, the following posting is made:

Debit 77 “Deferred liabilities” Credit 68.4 “Calculations for income tax.”

When the value of debts increases in addition to income tax, the following entry is made:

Credit 77 “ONO” Debit 68.4 “Calculations for income tax.”

If IT is removed from the balance sheet of the enterprise, then the posting will be as follows:

Debit 77 “Deferred liabilities” Credit 99 “Profits and losses”.

In this case, it is necessary to write off not only the amount of debt, but also the temporary difference.

For example, an organization sold a gas boiler. At the time of sale, the amount of accrued depreciation was:

- 400,000 rubles in tax accounting;

- 350,000 rubles in accounting.

Savings on ONO in the 77th account:

- 400,000 - 350,000 = 50,000 rubles;

- 50,000 * 20% = 3,000 rubles.

This means that the following must be written off from the balance sheet:

- Debit 77 Credit 99 “Profits and losses” - 3,000 for the amount of the deferred liability.

Typical situations

In this case, the credit balance of account 77 is displayed in expanded form in line 1420 and the debit balance from account 09 “Deferred tax assets” in the balance sheet asset on line 1180 of the “Non-current assets” section.

The collapsed view assumes a decrease in the credit balance of the 77th account by the debit of the 09th account.

Note from the author! If the income tax rate changes, the deferred liabilities must be recalculated in accordance with the change. The change in value is reflected in the balance sheet in the year following the reporting year. This circumstance is stipulated by PBU 18/02.

The content of the 1420 balance line is one of the most difficult aspects to understand and requires a good understanding of the differences. Incorrectly reflected amounts are fraught with arrears, fines and, accordingly, a full measure of liability.

>Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Save the article to social networks:

In this case, the following entries are made in accounting:

- when writing off IT - by the debit of account 99 in correspondence with the credit of account 09 “Deferred tax assets”;

- when writing off IT - by debiting account 77 “Deferred tax liabilities” in correspondence with the credit of account 99.

Reflection of account 77 in the balance sheet

When preparing the balance sheet, IT is recorded on line 1420 of the liability in the “Long-term liabilities” section. PBU 18/02 gives a choice of how to reflect the balance in this line.

There are 2 options:

- Full display. The balance of account 77 is recorded on line 1420 as a liability, and the balance of account 09 “Deferred tax assets” on line 1180, respectively, as an asset, in the “Non-current assets” section.

- Abridged version. With this method, the credit balance of account 77 must be reduced by the debit balance of account 09.

It is important to note that the deferred asset will not be an overpayment of income tax; they go separately from each other. Failure to understand this fact may result in fines and penalties.

Written off SHE and IT affect the amount of net profit (loss) for accounting purposes.

Let us give a formula for calculating net profit (loss), from which this will be clear. —————————————————————————————————————————————————— ———————————————¬ | Net profit (loss) of the reporting period (line 190 of the Profit and Loss Statement) | L————————————————————————————————————————————————— ———————————————— = ————————————————————————————————— —————————————————————————————————¬ | Profit (loss) before tax (line 140 of the Profit and Loss Statement) | L————————————————————————————————————————————————— ———————————————— + ————————————————————————————————— —————————————————————————————————¬ | Deferred tax assets (line 141 of the Profit and | | Loss Statement) = Difference between debit and credit turnover by | | account 09 in correspondence with account 68 for the reporting period | L————————————————————————————————————————————————— ———————————————— — ————————————————————————————————— ————————————————————————————————- | Deferred tax liabilities (line 142 of the Profit and Loss Statement) = Difference between credit and debit turnover by | | account 77 in correspondence with account 68 for the reporting period | L————————————————————————————————————————————————— ———————————————— — ————————————————————————————————— —————————————————————————————————¬ | Current income tax (line 150 of the Profit and | | Loss Statement) = Line 180 of sheet 02 of the Income Tax Declaration | | organizations for the reporting period | L————————————————————————————————————————————————— ———————————————— — ————————————————————————————————— —————————————————————————————————¬ | Deferred taxes written off during the reporting period | | assets upon disposal of objects for which these deferred| | tax assets (shown on the free line of the Statement of | | profit and loss after the current income tax + —————————————————————————————— ———————————————————————————————————¬ | Deferred tax liabilities written off during the reporting period | | liabilities upon disposal of assets , for which these | | deferred tax liabilities arose (shown on the free | | line of the Profit and Loss Statement after the current tax on | | profit +/- —————————————————— ———————————————————————————————————————————————¬ | Recalculation for income tax (for example, errors of previous years | | when calculating income tax) and payments from profit | | (for example, tax sanctions) (shown on free lines | | of the profit and loss statement after the current tax on | | profit)

Please note the fact that

> the amount reflected on account 99 as a result of writing off ONA or ONO upon disposal of the object

according to which they are calculated,

does not participate in the formation of accounting profit (loss) before tax

, from which the conditional income tax expense (income) is calculated.

The current income tax for the reporting period, reflected on line 150 of the Profit and Loss Statement, is the income tax calculated according to tax accounting data and shown on line 180 of sheet 02 of the Organizational Income Tax Declaration for the reporting period. If permanent tax assets and liabilities, as well as deferred taxes are correctly accounted for in accounting, then current income tax can also be calculated using the following formula