I. General provisions

1. This Regulation establishes the procedure for reflecting estimated liabilities, contingent liabilities and contingent assets in the accounting and reporting of organizations (with the exception of credit institutions) that are legal entities under the legislation of the Russian Federation (hereinafter referred to as organizations).

2. This Regulation does not apply to:

a) contracts under which, as of the reporting date, at least one party to the contract has not fully fulfilled its obligations, with the exception of contracts, the inevitable costs of execution of which exceed the proceeds expected from their execution (hereinafter referred to as obviously unprofitable contracts). A contract whose execution can be terminated by the organization unilaterally without significant sanctions is not a deliberately unprofitable one;

b) reserve capital, reserves formed from the organization’s retained earnings;

c) valuation reserves;

d) accounted for in accordance with the Accounting Regulations “Accounting for Income Tax Calculations of Organizations” PBU 18/02, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 N 114n (registered with the Ministry of Justice of the Russian Federation on December 31, 2002 , registration No. 4090) as amended by Orders of the Ministry of Finance of the Russian Federation dated February 11, 2008 No. 23n “On amendments to the Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n” (registered with the Ministry of Justice of the Russian Federation on March 3 2008, registration N 11274), dated October 25, 2010 N 132n “On amendments to regulatory legal acts on accounting” (registered with the Ministry of Justice of the Russian Federation on November 25, 2010, registration N 19048) (hereinafter referred to as the Regulation according to accounting “Accounting for calculations of corporate income tax” PBU 18/02), amounts that affect the amount of corporate income tax payable in the following reporting or subsequent reporting periods.

3. This Regulation may not be applied by small businesses, with the exception of small businesses - issuers of publicly placed securities.

Effect of PBU 8/2010

Effect of PBU 8/2010

Order of the Ministry of Finance of the Russian Federation dated December 13, 2010 N 167n approved the Accounting Regulations “Estimated Liabilities, Contingent Liabilities and Contingent Assets” (PBU 8/2010), establishing the procedure for reflecting estimated liabilities, contingent liabilities and contingent assets in the accounting and reporting of organizations.

This provision must be followed by all Russian legal entities with the exception of credit institutions.

According to paragraph 3 of PBU 8/2010, it may not be applied by small businesses, with the exception of small businesses - issuers of publicly offered securities.

PBU 8/2010 according to paragraph 2 does not apply to :

• contracts under which, as of the reporting date, at least one party to the contract has not fully fulfilled its obligations, with the exception of contracts, the inevitable costs of execution of which exceed the proceeds expected from their execution (hereinafter referred to as obviously unprofitable contracts). A contract whose execution can be terminated by the organization unilaterally without significant sanctions is not a deliberately unprofitable one;

• reserve capital, reserves formed from the organization's retained earnings; valuation reserves;

• accounted for in accordance with the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02, approved.

By Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 N 114n (hereinafter referred to as PBU 18/02), amounts that affect the amount of corporate income tax payable in the following reporting period or in subsequent reporting periods.

And here we can note some difficulties in applying PBU 8/2010.

Firstly, it is necessary to analyze the contracts available in the organization in order to establish the fulfillment of obligations under them and determine the list of obviously unprofitable contracts.

From the point of view of an accountant, we can talk about an inventory of liabilities, which is carried out in accordance with the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved. By Order of the Ministry of Finance of Russia dated June 13, 1995 N 49. It should be noted with regret that not all organizations carry out an inventory of liabilities in a timely manner.

We strongly recommend that you reconcile settlements with your counterparties.

When conducting an inventory, it will inevitably become clear that some debts (accounts receivable) need to be written off, or a decision will be made to begin pre-trial settlement procedures or seek protection of their rights in the courts.

The procedure for assessing an estimated liability for obviously unprofitable contracts is not defined in PBU 8/2010. In accordance with paragraph 7 of PBU 1/2008, when developing your accounting policies, you should use IFRS approaches. On this issue, experts refer to IFRS 37 “Provisions, contingent liabilities and contingent assets”.

Therefore, the accountant must exercise his or her own professional judgment on this matter.

We recommend developing a standard form that will document the accountant’s professional judgment on a particular issue. Attach the primary document (or copies of primary documents) to the accountant’s written professional judgment.

The organization may develop another form of making professional judgment, for example, collegial.

The second problem with this standard is the lack of a clear definition of the concept of estimated reserves in accounting regulations.

According to clause 11 of PBU 10/99, estimated reserves are reserves created in accordance with accounting rules.

The list of these reserves, on the one hand, is non-exhaustive, but on the other hand, these reserves can only be created in accordance with accounting rules.

These are the reserves that can now be recognized:

• to reduce the cost of inventories (PBU 5/01);

• for depreciation of financial investments (PBU 19/02);

• for doubtful debts (clause 70 of the PVBU).

In addition, according to clause 11 of PBU 10/99, it is necessary to include reserves created in connection with the recognition of contingent facts of economic activity as valuation reserves.

At the same time, according to clause 3 of the currently inactive PBU 8/01, a conditional fact of economic activity is a fact of economic activity occurring as of the reporting date, regarding the consequences of which and the likelihood of their occurrence in the future there is uncertainty, i.e. the occurrence of consequences depends on whether one or more uncertain events occur or do not occur in the future.

A new definition of “conditional facts” has not yet been given, and probably will not be given.

Experts believe that estimated liabilities are recognized as estimated values in accordance with clause 2 of PBU 21/2008, based on the general definition of estimated values, and PBU 8/2010 does not apply to estimated reserves in accordance with clause 2 of PBU 8/2010.

According to other experts, the creation of estimated reserves from 01/01/2009 is considered as a change in estimated values in accordance with paragraphs 2, 3 of the Accounting Regulations “Changes in estimated values” (PBU 21/2008) (Appendix No. 2 to the Order of the Ministry of Finance of Russia dated 06.10.2008 N 106n) (hereinafter referred to as PBU 21/2008).

Thus, a number of specialists extend the effect of PBU 8/2010 to estimated reserves.

Logical reasoning leads to both conclusions, which, in our opinion, indicates the imperfection of existing PBUs. In our opinion, official clarifications from the Russian Ministry of Finance are necessary.

We were faced with a situation where it was necessary to find out whether PBU 8/2010 applies when forming a “reserve” for vacation pay.

There is currently no legal act regulating the creation of a reserve for vacation pay in accounting.

In our opinion, the concept of “expenses for the payment of vacation pay and employee benefits at the end of the year” fits the definition of an estimated liability.

Based on the explanations of I.R. Sukharev (Ministry of Finance of Russia) on p. 32 in the journal “Glavnaya Ledger”, 2011, No. 7: “In connection with the release of PBU 8/2010 on estimated liabilities and amendments to Order No. 34n, organizations no longer have the right to choose whether to create this or that reserve. They are either obliged to create a specific reserve, or, conversely, do not have the right to create it. Obligations to pay for vacations are, of course, estimated liabilities. After all, the right to paid leave arises as the employee works for the organization. This means that the organization can calculate what obligations it has to pay vacation pay as of the reporting date.”

Indeed, according to paragraph 5 of PBU 8/2010, the concept of “obligation to pay for vacations” fits the special case of an estimated liability. All three conditions are met at the same time:

• an obligation resulting from past events in her economic life exists, since vacations are granted after completing a certain length of service in accordance with current labor legislation,

• in this case, there is definitely a decrease in the economic benefits of the organization,

• and the amount of the obligation to pay vacation pay can be reasonably estimated by calculating the employee’s average earnings.

"5. An estimated liability is recognized in accounting if the following conditions are simultaneously met:

• the organization has an obligation resulting from past events in its economic life, the fulfillment of which the organization cannot avoid. In the event that an organization has doubts about the existence of such an obligation, the organization recognizes a provision if, as a result of an analysis of all circumstances and conditions, including the opinions of experts, it is more likely than not that the obligation exists;

• a decrease in the economic benefits of the organization necessary to fulfill the estimated liability is likely;

• the amount of the provision can be reasonably estimated.”

On the other hand, employment contracts are contracts under which, as of the reporting date, both parties to the contract have not fully fulfilled their obligations.

It should also be noted that, according to clause 4 of PBU 8/2010, an estimated liability is an obligation of an organization with an uncertain amount and (or) deadline.

According to Article 123 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), the priority for the provision of paid leave is determined annually in accordance with the vacation schedule approved by the employer, taking into account the opinion of the elected body of the primary trade union organization no later than two weeks before the start of the calendar year in the manner established Article 372 of the Labor Code of the Russian Federation for the adoption of local regulations.

The vacation schedule is mandatory for both the employer and the employee. Thus, the deadline for fulfilling the obligation to pay for vacations is quite clearly defined.

The widespread opinion that the amount of the obligation is uncertain because the employee’s average daily earnings is subject to change can only be recognized conditionally. Due to the fact that in this case the payment of wages itself has signs of an estimated liability and, by and large, a reserve should also be formed for the amount of this liability.

On the other hand, since the reserve is not created for each employee, but for the organization as a whole, we do not know exactly the amount of funds associated with the payment of vacation pay that will be required. It is also impossible to say with certainty when certain funds will be needed. Some of the employees will quit within a year, others will come as transfers with the same length of service on vacation.

We, however, believe that the cost of paying vacation pay and employee benefits at the end of the year should be assessed as an estimated liability.

Now, in support of this opinion, one can refer not only to the analogy of the law or the private opinion of specialists, but also to the official Letter of the Ministry of Finance of Russia dated June 14, 2011 N 07-02-06/107.

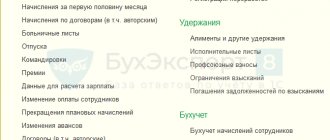

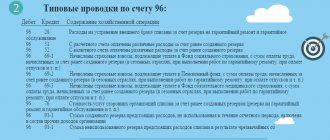

When forming a “reserve” for the payment of average wages when providing annual paid leave, the following entries must be made:

• Dt 20 (23, 25, 26, 28, 29, 44, 91-2) - Kt 96 - an estimated liability in the amount of planned vacation payments was recognized. The moment of occurrence is appropriate, at the end of the year

• Dt (23, 25, 26, 28, 29, 44, 91-2) – Kt 96 – the amount of the estimated liability has been increased if necessary.

• Kt 20 (08, 23, 25, 26, 28, 29, 44, 91-2) - Dt 96 - an estimated liability in the amount of paid retained average earnings and monetary compensation for unused leave upon dismissal was written off.

• Dt 96 Kt 91-1 - the unused amount of the estimated liability is written off at the end of the year.

Please note that in the IFRS system there is a special standard IFRS 19 “Employee Benefits” and IFRS 37 is not fully applied to reserves (liabilities) associated with payments to employees for labor.

III. Determining the amount of the estimated liability

15. An estimated liability is recognized in the organization's accounting records in an amount that reflects the most reliable monetary estimate of the costs necessary to settle this liability. The most reliable estimate of expenses is the amount required directly to fulfill (repay) the obligation as of the reporting date or to transfer the obligation to another person as of the reporting date.

16. The amount of the estimated liability is determined by the organization on the basis of existing facts of the organization’s economic life, experience in fulfilling similar obligations, as well as, if necessary, expert opinions. The organization shall provide documented evidence of the validity of such assessment.

17. When determining the amount of the estimated liability, the organization proceeds from the following:

a) if the amount of the estimated liability is determined by selecting from a set of values, then the weighted average value is taken as such value, which is calculated as the average of the products of each value and its probability;

b) if the amount of the estimated liability is determined by selecting from an interval of values and the probability of each value in the interval is equal, then the arithmetic mean of the largest and smallest values of the interval is taken as such a value.

Examples of determining the amount of an estimated liability are given in Appendix No. 2 to these Regulations.

18. When determining the amount of the estimated liability, the following are taken into account:

a) the consequences of events after the reporting date in accordance with the Accounting Regulations “Events after the reporting date” (PBU 7/98), approved by Order of the Ministry of Finance of the Russian Federation dated November 25, 1998 N 56n (registered with the Ministry of Justice of the Russian Federation on December 31 1998, registration N 1674) as amended by Order of the Ministry of Finance of the Russian Federation of December 20, 2007 N 143n (registered with the Ministry of Justice of the Russian Federation on January 21, 2008, registration N 10934);

b) risks and uncertainties inherent in this estimated liability;

c) future events that may affect the amount of the provision (if there is a reasonable probability that these events will occur).

19. When determining the amount of the estimated liability, the following are not taken into account:

a) the amount of decrease or increase in corporate income tax, which is reflected in accounting and reporting in accordance with the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18/02;

b) expected proceeds from the sale of fixed assets, intangible assets, products, goods and other assets associated with the recognized estimated liability. Such revenues are reflected in the accounting records of the organization in accordance with the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 N 32n (registered with the Ministry of Justice of the Russian Federation on May 31, 1999, registration N 1791) as amended by Orders of the Ministry of Finance of the Russian Federation dated March 30, 2001 N 27n “On introducing amendments and additions to regulatory legal acts on accounting” (registered with the Ministry of Justice of the Russian Federation on May 4, 2001, registration N 2693), dated September 18, 2006 N 116n “On amendments to regulatory legal acts on accounting” (registered with the Ministry of Justice of the Russian Federation on October 24, 2006, registration N 8397), dated November 27, 2006 N 156n “ On amendments to regulatory legal acts on accounting" (registered with the Ministry of Justice of the Russian Federation on December 28, 2006, registration N 8698), dated October 25, 2010 N 132n "On amendments to regulatory legal acts on accounting" ( registered with the Ministry of Justice of the Russian Federation on November 25, 2010, registration N 19048); dated November 8, 2010 N 144n “On amendments to regulatory legal acts on accounting (registered with the Ministry of Justice of the Russian Federation on December 1, 2010, registration N 19088);

c) expected amounts of counterclaims or amounts of claims against other persons for reimbursement of expenses that the organization is expected to incur in fulfilling this estimated liability.

If the organization has confidence in the receipt of economic benefits from counterclaims or claims to other persons when the organization fulfills the corresponding estimated liability accepted for accounting, such claims are recognized in accounting as an independent asset. The amount of such an asset should not exceed the amount of the corresponding estimated liability. In the organization's balance sheet, the amount of a recognized provision is not reduced by the amount of such an asset.

In the organization's profit and loss statement, expenses reflected when recognizing estimated liabilities are presented minus income recognized when accounting for expected proceeds from counterclaims and claims against other persons as an asset.

20. If the expected period for fulfillment of an estimated liability exceeds 12 months after the reporting date or a shorter period established by the organization in its accounting policies, such an estimated liability is assessed at a cost determined by discounting its value, calculated in accordance with paragraphs 16 - 19 of these Regulations (hereinafter - present value).

Discount rate used by the organization:

a) must reflect the conditions existing in the financial market, as well as the risks specific to the obligation underlying the recognized provision;

b) should not reflect the amount of decrease or increase in the organization’s income tax, which are reflected in accounting and reporting in accordance with the Accounting Regulations “Accounting for calculations of income tax of organizations” PBU 18/02, as well as risks and uncertainties that were taken into account when calculating future cash payments caused by the estimated liability in accordance with paragraphs 16 - 19 of these Regulations.

An increase in the amount of an estimated liability due to an increase in its present value on subsequent reporting dates as the deadline approaches (interest) is recognized as another expense of the organization.

An example of determining the present value of an estimated liability is given in Appendix No. 2 to these Regulations.

Contingent liabilities and contingent assets

A contingent liability is a consequence of past business events that in the future may give rise to an obligation for the organization at the reporting date and which depends on the occurrence (non-occurrence) of one or more future uncertain events beyond the control of the organization.

Example 2. Let us partially reformulate the conditions of example 1. Let us assume that as of December 31, 2011, the financial position of the subsidiary has worsened, but it continues to operate. According to independent experts, there is a high probability that she will be able to repay her obligations under the loan agreement by no more than 50%. In this case, as of the reporting date of December 31, 2011, the organization has a contingent obligation arising as a result of past events of its activities, the fulfillment of which it cannot avoid (the guarantee agreement must be fulfilled). A decrease in economic benefits as a result of fulfilling an obligation under a guarantee agreement is quite likely. Estimated liabilities for the upcoming execution of the guarantee agreement can be fairly reasonably estimated (the amount can be 500,000 rubles (1,000,000 rubles x 50%)).

A contingent asset is a possible asset that arises from past events and whose existence will be confirmed by the occurrence or non-occurrence of one or more future uncertain events beyond the entity's control.

Example 3. During the reporting period, the organization filed a lawsuit against the debtor, who must return part of the goods to the organization and pay a penalty in accordance with the agreement. The organization appreciates the likelihood that the court will rule in its favor. In this case, the past event is the previously concluded contract. The organization cannot control the court decision. The possible return of goods is a contingent asset of the organization.

Unlike provisions, contingent liabilities and contingent assets are not recognized in accounting. An organization must disclose information about contingent liabilities and contingent assets in its financial statements. By establishing this procedure, the developers eliminated the contradiction that existed earlier in PBU 8/01. Let us recall that, according to paragraphs 6 and 7 of this document, contingent assets and contingent liabilities should be reflected differently in the balance sheet. It was indicated that contingent assets should not be reflected in the accounts. As for contingent liabilities, they should be divided into two groups. For those obligations that existed at the reporting date, organizations had to create a reserve in accounting. And regarding possible obligations, information should have been disclosed in an explanatory note. As experts noted, a conflict arose in which in Russian accounting any element could be recognized in the reporting, but at the same time had to be reflected outside it. This was contrary to logic, IFRS, and the principles of truthful and transparent reflection of information in financial statements.

Now this discrepancy has been eliminated, and the wording in PBU 8/2010 began to correspond to the interpretations of IFRS. Also, in order to bring the new standard into compliance with IFRS clause 11 PBU 8/2010, organizations are required to analyze estimated liabilities associated with the restructuring of their activities.

IV. Write-off, change in the amount of an estimated liability

21. During the reporting year, when actual calculations are made for recognized estimated liabilities, the organization's accounting records reflect the amount of the organization's costs associated with the organization's fulfillment of these obligations, or the corresponding accounts payable in correspondence with the reserve account for future expenses.

A recognized estimated liability may be written off to reflect costs or recognize accounts payable for the fulfillment of only the obligation for which it was created, unless otherwise provided by these Regulations.

If the amount of the recognized estimated liability is insufficient, the organization's costs to repay the liability are reflected in the organization's accounting records in the general manner.

22. In the event of an excess of the amount of the recognized estimated liability or in the event of termination of fulfillment of the conditions for recognition of the estimated liability established by paragraph 5 of these Regulations, the unused amount of the estimated liability is written off and assigned to other income of the organization, unless otherwise established by this paragraph.

When repaying homogeneous estimated liabilities arising from recurring business transactions in the ordinary course of the organization's activities, previously recognized excess amounts are applied to subsequent estimated liabilities of the same type immediately upon their recognition (without writing off previously recognized excess amounts to other income of the organization).

23. The validity of recognition and the amount of the estimated liability are subject to verification by the organization at the end of the reporting year, as well as upon the occurrence of new events related to this liability.

Based on the results of such a check, the amount of the estimated liability may be:

a) increased in the manner established for the recognition of an estimated liability by paragraph 8 of these Regulations (without inclusion in the value of the asset), upon receipt of additional information that allows the amount of an estimated liability to be clarified;

b) reduced in the manner established for writing off an estimated liability by paragraph 22 of these Regulations, upon receipt of additional information that allows the amount of an estimated liability to be clarified;

c) remain unchanged;

d) written off in full in the manner established by paragraph 22 of these Regulations, upon receipt of additional information allowing one to conclude that the conditions for recognition of an estimated liability established by paragraph 5 of these Regulations have ceased to be met.